October 31, 2023

Costa Ballena Real Estate Market Report (Second Quarter, 2023): Captivating Insights and Lucrative Investment Prospects

The information provided in this Real Estate Market Report is for general informational purposes only and should not be considered as investment advice. Readers are encouraged to independently verify the data and seek advice from qualified experts before making any real estate decisions.

Join us for our Osa Tropical Properties mid-year in-depth analysis of Costa Rica’s real estate market in 2023, with a particular focus on the vibrant Costa Ballena region. In the second quarter of the year, the Costa Ballena real estate market exhibited robust demand, limited supply, and ascending property prices in certain brackets. Notably, there was a significant surge in the number of properties sold, rising from 51 in Q1 to an impressive 76 in Q2. The average list-to-sold price ratio for all properties in Costa Ballena stood at an impressive 94.1%, while properties typically spent a median of 188 days on the market.

While comparing these results to the same period in the previous year, it’s evident that the market experienced a noteworthy downturn, with total sales amounting to $32.5 million, down from $44 million in the second quarter of 2022. Despite this decline, multiple property types, including luxury homes, land, and modern homes under $400,000 experienced robust activity, indicating the resilience and diversity of the Costa Ballena real estate market.

Whether you are an astute investor or an eager buyer seeking to delve into the Costa Rican real estate market, this analysis promises to provide valuable insights and illuminate the enticing prospects that await in the enchanting realm of Costa Ballena’s property landscape.

Our Methodology

The data presented in this market report has been meticulously gathered from a variety of reputable sources, including the esteemed Costa Ballena Real Estate Board, our Osa Tropical Properties MLS database, and industry-leading analytics portals like AirDNA. Our Osa Tropical Properties team of experienced real estate professionals has meticulously verified this data to ensure its accuracy and reliability.

However, we acknowledge certain limitations in the data collection process. While our office diligently collects data on new listings, price changes, and status updates from various sources within Costa Ballena, it’s important to note that not all real estate offices may share their complete listings or sales price information. Additionally, transactions involving FSBO (For Sale By Owner) properties and direct sales by developers are not accounted for in this report due to inconsistencies in available information. Nonetheless, we estimate that such cases constitute a relatively small percentage of the overall market.

For the sake of uniformity and ease of comprehension, all prices in this report are presented in US Dollars, as the vast majority of real estate transactions in Costa Rica are conducted in this currency rather than Colones.

To contextualize the market’s current state, we have chosen to compare the second quarter of this year (April, May, June) with the corresponding periods in 2021 and 2022. This comparison allows us to illustrate how the surge in buyer activity has transitioned from the heightened levels observed during the pandemic-induced frenzy, as individuals sought refuge from global changes. The second quarter of this year has returned to a more customary quiet season, characterized by fewer travelers visiting Costa Rica due to the school year and the commencement of the rainy season on the Pacific Coast in comparison to the start of the year, which is the busiest time for tourism in Costa Rica.

By employing these rigorous methodologies and acknowledging any potential limitations, our market report aspires to furnish valuable insights and highlight prominent trends in the Costa Ballena real estate market. Our ultimate objective is to empower both buyers and sellers with the knowledge necessary to make informed decisions, enabling them to seize opportunities in this market of Costa Rican real estate.

Classification of Areas:

Each area within the Costa Ballena region is classified under the name of its main town. However, it is essential to note that each region encompasses a multitude of distinct neighborhoods separated by highway driving, with each neighborhood reliant on one of the three central hub towns for essential services and daily interactions. For the purposes of this report, we have chosen to group together various distinct neighborhoods that would otherwise be considered separate:

- The Dominical area comprises various villages, including Baru, Dominicalito, Escaleras, San Martin, Platanillo, Lagunas, and more.

- Uvita encompasses Bahia, Hermosa, San Josecito, Las Brisas, and several other smaller locales.

- The Ojochal area represents the villages of Tres Rios, Coronado, Chontales, Pinuelas, and Cinco Ventanas, along with some additional smaller neighborhoods.

These classifications provide a comprehensive understanding of the diverse neighborhoods that contribute to the vibrant tapestry of Costa Ballena’s real estate market.

Overview of the Real Estate Market in Costa Ballena

The Costa Ballena real estate market in Q2 2023 is experiencing strong demand and limited supply in certain hot markets, leading to rising home prices in certain sectors. The region’s vibrant and growing market offers various property types, driven primarily by tourism and international travelers. Factors such as natural beauty, climate, and the influx of retirees and digital nomads contribute to the strong demand. However, the supply shortage of brand new, high-end properties in the $500,000 to $1 million range has caused property prices to decrease 54% in the past year. The decline in the average price of sold properties alongside the increase in the number of sold properties shows that the market is eager to buy but the primary selections are ocean view land and new modern homes in Uvita, both of which tend to be listed for below $400,000.

Key Highlights:

- Total sales in Q2 2023 surpassed $33.5 million, and average sales values of all properties dropped by 3.38% in the first six months of the year.

- The rental market is robust, with average daily rates of $212 in the Bahia Ballena area and $150 in the Puerto Cortes region.

- Top amenities sought by renters are internet access, parking, and well-equipped kitchens.

- The average construction size of properties sold during this quarter was 2,368 sq. ft., lower than the average size recorded in Q2 2022.

- The number of vacant lots sold in the second quarter of this year has increased over previous years, bringing down the average value of properties sold.

Comparative Analysis To Previous Quarters:

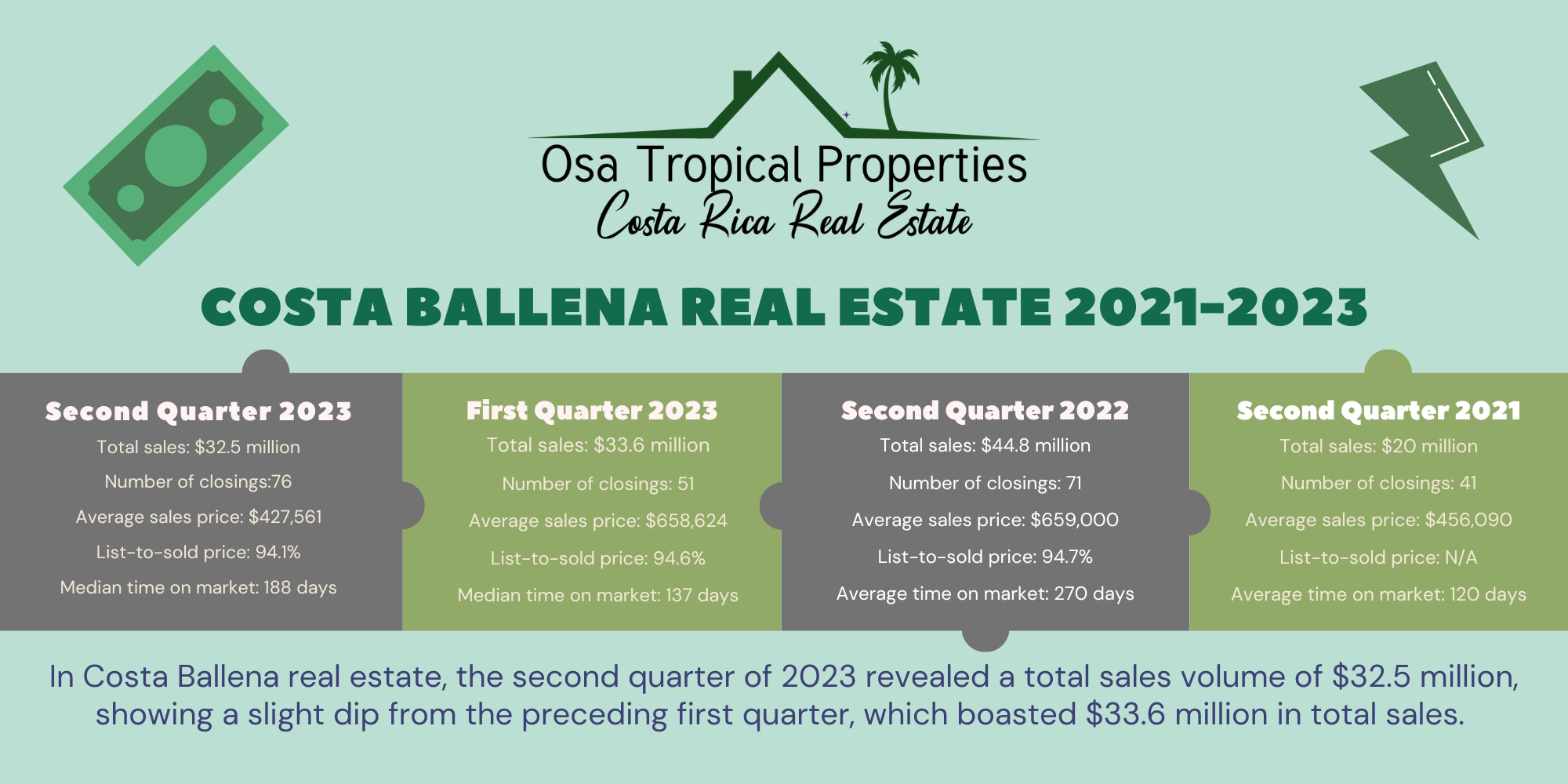

In Costa Ballena real estate, the second quarter of 2023 revealed a total sales volume of $32.5 million, showing a slight dip from the preceding first quarter, which boasted $33.6 million in total sales. Nonetheless, it is imperative to highlight that the second quarter of 2023 still demonstrated impressive growth compared to the year 2021, where total sales amounted to a modest $20 million.

Within this period, the market witnessed 76 closings, showcasing a noteworthy improvement over the first quarter of 2023, which recorded 51 closings. Furthermore, this figure surpasses the number of closings reported in the second quarter of 2022 (72 properties) and the second quarter of 2021 (41 properties). The majority of properties that sold in this past quarter were modern small homes in Uvita and ocean view lots.

The average sales price during the second quarter of 2023 settled at $427,561, marking a notable decline from the first quarter’s average of $658,624 and from Q2 2022. This decline in average sold price shows that more buyers are purchasing land and smaller homes to be used as rental properties in the fast-growing market of Central Uvita.

The list-to-sold price ratio remained steady at 94.1% for both the first and second quarters of 2023, indicating a consistent trend in the market, in spite of a small decline. Prices are holding strong because buyers see value in the properties they purchase, although they are purchasing less expensive properties.

In terms of the median time properties spent on the market, the second quarter of 2023 recorded a figure of 188 days, slightly higher than the first quarter of 2023 (137 days). Nevertheless, this still represents a substantial improvement from the second quarter of 2022, where the average time on the market was 270 days, and the year 2021, with an average of 120 days. Last year’s long days on market shows that in the buying frenzy of 2022, older and less desirable properties that sat on the market for a long period of time were finally being purchased in the limited supply market of 2022.

Throughout the ongoing pandemic, the real estate market in Costa Ballena, particularly in sought-after destinations like Uvita, has experienced fluctuations and volatility. However, the second quarter of 2023 displayed encouraging signs of progress, with enhanced total sales and closings compared to the previous year (2021), despite a minor decrease in average sales prices. Remarkably, the market has maintained a commendable level of stability, exemplified by the consistent list-to-sold price ratio. This data underscores Costa Ballena’s enduring allure to potential buyers in search of secure and inviting havens, contributing to the sustained demand for properties in the region. As we navigate the evolving landscape of the pandemic, vigilantly monitoring market trends will be pivotal in comprehending the long-term impacts on the esteemed real estate industry in Costa Rica.

Property Sales and Under Contract Trends

In the second quarter of 2023 (April, May, June), the real estate market in Costa Ballena witnessed significant activity and notable trends. Below are the key highlights and statistics from this period:

Sold and Pending Deals:

- Total sold and pending deals: 76

- Complete closings: 58

- Luxury Properties (Over $1 Million): 7

- All Homes: 38

- All Land: 33

- Farms (Over 10 Acres): 1

- Commercial/Business: 3

- Condos: 1

Average Prices in Costa Ballena:

- All Houses Average Price: $618,571

- All Land Average Price: $215,757

- All Properties Average Price: $427,561

General Statistics:

- Properties over $1 million sold: 7

- Total sales (as per listing price – actual sold prices not available): $32,494,700

- Average construction size of all properties sold: 2,368 ft²

- Average acreage: 2.093 acres

- Average number of bedrooms: 2.95

- Average number of bathrooms: 2.5

Market Changes:

- Price reductions: 50 properties

- Price increases (usually due to construction completions or upgrades): 2 properties

- Newly listed properties from other offices: 107 properties (Note: Not all newly listed properties are shared with our office, but the majority are.)

- Newly listed properties with our office: 30 properties

- Properties taken off the market: 17 properties (sellers decided to retain the property for rental income or pursue upgrades before delisting)

The Costa Ballena real estate market continued to showcase its resilience during the second quarter of 2023, witnessing the successful sale or contracting of 76 properties, culminating in an impressive sales volume of $32,494,700. The average list price for properties stood at $425,983.

While the average list-to-sold price ratio experienced a slight decline from 96.4% in the first quarter of 2023 to 94.1% in the second quarter, the market remained steadfast. Simultaneously, the average time on the market increased from 165 days to 188 days, signaling a measured but stable pace of transactions during this period.

Uvita emerged as the most active market, boasting 28 properties sold or under contract, indicating a robust demand in this captivating locale.

Within the market’s segments, luxury homes and land emerged as standout performers. An impressive 7 properties were transacted at prices exceeding $1 million, while 33 properties in the land category were sold or under contract, reflecting strong demand.

The properties sold during the second quarter boasted an average size of 2,368 square feet, featuring an inviting average of 2.95 bedrooms and 2.5 bathrooms, catering to diverse preferences and needs.

Property Sales By Region (Dominical, Uvita, and Ojochal)

The real estate market in the Dominical, Uvita, and Ojochal areas exhibited significant demand, with a variety of property types available. The average prices for houses, land, and all properties in Costa Ballena remained robust, reflecting the attractiveness of the region.

Dominical:

- Total Listing Value of Properties Sold and Under Contract: $10,427,000

- Average Listing Price of Properties Sold and Under Contract: $802,076

- Total Number of Homes Sold and Under Contract: 13

Dominical – Houses Only:

- Total Listing Value of Homes Sold and Under Contract: $9,059,000

- Average Listing Price of Homes Sold and Under Contract: $1,006,555

- Number of Homes Sold and Under Contract: 9

Dominical – Land Only:

- Total Listing Value of Land Sold and Under Contract: $1,368,000

- Average Listing Price of Land Sold and Under Contract: $342,000

- Number of Land Properties Sold and Under Contract: 4

Uvita:

- Total Listing Value of Properties Sold and Under Contract: $12,840,800

- Average Listing Price of Properties Sold and Under Contract: $458,600

- Total Number of Homes Sold and Under Contract: 28

Uvita – Houses Only:

- Total Listing Value of Houses Sold and Under Contract: $8,892,800

- Average Listing Price of Houses Sold and Under Contract: $523,105

- Number of Homes Sold and Under Contract: 17

Uvita – Land Only:

- Total Listing Value of Land Sold and Under Contract: $2,543,000

- Average Listing Price of Land Sold and Under Contract: $317,875

- Number of Land Properties Sold and Under Contract: 8

Ojochal:

- Total Listing Value of Properties Sold and Under Contract: $9,226,900

- Average Listing Price of Properties Sold and Under Contract: $263,625

- Total Number of Homes Sold and Under Contract: 35

Ojochal – Houses Only:

- Total Listing Value of Houses Sold and Under Contract: $5,553,900

- Average Listing Price of Houses Sold and Under Contract: $462,825

- Number of Homes Sold and Under Contract: 12

Ojochal – Land Only:

- Total Listing Value of Land Sold and Under Contract: $3,578,000

- Average Listing Price of Land Sold and Under Contract: $162,636

- Number of Land Properties Sold and Under Contract: 22

The data above provides a snapshot of the real estate market in Dominical, Uvita, and Ojochal. These areas have seen substantial activity in terms of properties sold and under contract. Average listing prices vary across different property types and locations, offering a diverse range of opportunities for prospective buyers and investors. The market in Dominical and Uvita appears to be particularly robust, with a significant number of properties sold and under contract. Ojochal also shows promising activity, especially in the land sector, where 22 properties have been sold and under contract. Overall, these areas continue to attract interest from individuals seeking to invest in Costa Rica’s real estate market.

Average List-To-Sold Price Ratio

In the second quarter of 2023, the average list-to-sold price ratio for properties in Costa Ballena was approximately 94.1%. This means that, on average, properties sold for 94.1% of their list price. The list-to-sold price ratio remained relatively consistent with previous quarters, indicating a strong and healthy market.

Variations in list-to-sold price ratios were observed among different property types. Luxury homes had an average ratio of 92.9%, while all land had an average ratio of 91.1%. Homes in Costa Ballena sold for 96.4% of their list price. These differences in ratios may be influenced by factors such as property demand, unique features, and market dynamics specific to each property type.

Overall, the Costa Ballena real estate market demonstrated a strong demand with properties selling close to their asking price. Variations in list-to-sold price ratios across different property types can provide valuable insights for both buyers and sellers in the market.

List-To-Sold Price Statistics:

- Average list-to-sold price for all properties in Costa Ballena: 94.1%

- Properties over $1 million sold for 92.9% of list price, with homes selling closest to asking price (96.4%).

- Uvita had the highest list-to-sold price ratio at 98%, with one home selling at 16% over asking price due to competing offers in the desirable Bahia modern home market. This home is 3 years old with new furniture and well-maintained in a popular area.

- New homes (2020 and newer) sold for 99.625% of list price in the 2nd quarter of 2023.

- The majority of properties that sold for closest to asking price or above were new homes at an average price of $515k.

- Older homes (built prior to 2020) sold for closer to 93% of their list price, with the oldest homes selling for less.

- Land that sold for asking price all had spectacular views of the ocean or a river view and were at least an acre in size.

Average Time on Market

In the second quarter of 2023, the average time on market for properties in Costa Ballena was approximately 60 days, showing a significant decrease from 90 days in the previous quarter. This shorter time on the market suggests a strong demand and increased speed of property sales.

Differences in time on market were observed across property types. Luxury homes had an average time on market of 160 days, while all land had an average time on market of 158 days. Farms, commercial properties, and condos had average times on market of 200 days or more. These variations may be influenced by factors such as property type-specific demand, unique features, and market dynamics.

Time on Market For Properties In Costa Ballena:

- Average Time on Market (All properties sold in Costa Ballena): 250 days

- Median Time On Market (All Properties Sold in Costa Ballena): 188 days

Median Time On Market (in days from list to sold dates) for specific categories:

- Luxury Homes: 160 days

- All Homes: 188 days

- Businesses: 218 days

- All Land: 158 days

- Condo: 216 days

The average time on the market for properties in Costa Ballena is a challenging figure to present because many properties in this region remain on the market for a long time before finding the right buyer. These idiosyncratic properties do not represent the actual real estate market for newer, modern, single-family homes, which represent the bulk of sales in this region, typically being listed for less than 6 months before selling with the most popular homes often going under contract within days of listing. Overall, the real estate market in Costa Ballena continues to demonstrate stability, with various property types available to cater to the diverse preferences of buyers.

Market Segmentation

The Costa Ballena real estate market can be segmented based on property type, location, and price range.

- Property Type: The market comprises various property types, including luxury homes, all land, farms, commercial/business properties, and condos. Residential properties, including luxury homes and condos, are highly sought after, followed by commercial properties and land for development or investment purposes.

- Location: The market can be segmented into distinct areas such as Dominical, Uvita, and Ojochal, each with its unique appeal. Dominical and Uvita are popular tourist destinations, with higher property prices compared to Ojochal.

- Price Range: The market is categorized into low-cost, mid-cost, and high-cost properties. The majority of properties fall below $1 million, with growing demand for luxury homes priced above $2 million.

These segments illustrate the diverse dynamics of the Costa Ballena real estate market, with residential properties leading in sales volume and demand, followed by commercial properties and land. The location significantly impacts property prices, with Dominical and Uvita commanding higher values due to their popularity among tourists and investors. Understanding these segmentation factors provides valuable insights into the performance and preferences of buyers in the region.

Supply and Demand Analysis

The Costa Ballena real estate market thrives on robust demand, while the availability of properties remains constrained, creating a state of balance asymmetry.

The limited supply of properties can be attributed to various factors, including the region’s natural beauty, its strategic proximity to major tourist attractions, and its allure among foreign buyers. Additionally, stringent environmental regulations and limited developable land further contribute to the scarcity of properties available for sale.

On the other hand, demand for properties in Costa Ballena is driven by multiple factors. The region’s increasing popularity as a coveted tourist destination appeals to both local and international buyers. Moreover, Costa Ballena’s charm resonates with retirees and digital nomads seeking an idyllic setting. The presence of new financing options in the market serve as an additional catalyst, intensifying the demand for properties.

This persistent supply-demand disparity culminates in elevated property prices across Costa Ballena. As a highly sought-after destination with limited inventory, the real estate market in the region remains fiercely competitive and incredibly vibrant. Discerning buyers and sellers are presented with an enticing panorama of investment prospects, creating an atmosphere of opportunity.

Market Drivers and Trends

The real estate market is expected to continue performing well, driven by the region’s appeal and growing foreign investment. Strong demand for luxury properties, ocean view homes, and sustainable properties continues this quarter thanks to government initiatives in sustainability and foreign investment attraction positively influence buyer perceptions.

Key Drivers:

- The region’s natural beauty and climate attract both local and foreign buyers.

- The growing number of retirees and digital nomads relocating to Costa Rica drives demand for properties.

- Costa Rica’s increasing popularity as a tourist destination boosts property demand.

- Favorable tax laws in Costa Rica attract investors and buyers.

- New financing options are making property purchases more accessible.

- Tourism to Costa Rica is on the rise, with significant increases in visitors from North America and Europe. The influx of tourists fuels demand for vacation homes in Costa Ballena, impacting the rental market positively.

- The limited supply of properties in Costa Ballena creates an imbalance with strong demand, leading to higher prices.

- High construction costs and the scarcity of available land contribute to the supply shortage.

Rental Data in Costa Ballena

When it comes to vacation rentals in Costa Ballena, the Bahia Ballena area (Uvita and Dominical) and Puerto Cortes (Ojochal south) stand out as popular destinations. Here is a summary of the rental data for each area:

Bahia Ballena (North of Ojochal to Uvita and Dominical):

- There are currently 1,398 active rentals in the Bahia Ballena area.

- The average daily rate for rentals is $212, with a low of $189 in September and a high of $237 in March.

- The occupancy rate averages at 61%, reaching a low of 40% in September and a high of 82% in February.

- The average monthly revenue for rentals is approximately $2,351.

- About 78% of properties in Bahia Ballena are offered as entire home rentals (as opposed to apartments or shared homes).

- Airbnb is the dominant rental channel, representing 75% of the market share.

- The average rental property in Bahia Ballena consists of 2.5 bedrooms and accommodates 5.9 guests.

- The rental market in Bahia Ballena has shown consistent quarterly growth, with nearly every quarter surpassing the previous one since 2020.

- The top amenities sought by renters in this area are internet access, parking, and a well-equipped kitchen.

Puerto Cortes (Ojochal south to Palmar):

- There are currently 327 active rentals in the Puerto Cortes region.

- The average daily rate for rentals is $150, with a low of $130 in August and a high of $173 in June.

- The occupancy rate averages at 50%, reaching a low of 33% in September and a high of 68% in February.

- The average monthly revenue for rentals is approximately $1,560.

- About 84% of properties in Puerto Cortes are offered as entire home rentals.

- Airbnb is the dominant rental channel in this region, representing 72% of the market share.

- The average rental property in Puerto Cortes consists of 2.3 bedrooms and accommodates 5.3 guests.

- The rental market in Puerto Cortes has experienced consistent quarterly growth, with nearly every quarter surpassing the previous one since 2020, except for a slight dip in late 2021.

- Similar to Bahia Ballena, the top amenities sought by renters in Puerto Cortes are internet access, parking, and a well-equipped kitchen.

It’s important to note that while Ojochal does have luxury and high-end properties that can command rates over $1,000 per night, the average daily rate for rentals in Puerto Cortes is influenced by the more affordable regions within this district, such as Cortes, Balsar, and Palmar Norte.

Tourism in Costa Rica in 2023

Costa Rica, celebrated for its awe-inspiring natural beauty and diverse landscapes, has long been a favored destination for tourists. This report meticulously analyzes the tourism trends in the initial five months of 2023, juxtaposed with previous years, with a particular focus on visitor numbers and their regional origins.

In 2023, Costa Rica’s tourism sector has displayed robust growth, witnessing a remarkable 19.4% increase in visitors during the first half of the year compared to 2022. This surge can be attributed to several influential factors, including the country’s commendable safety record, natural splendors, and a diverse array of activities and attractions.

A significant milestone for Costa Rica’s tourism industry was achieved in 2019 when the country experienced its highest-ever influx of visitors, welcoming a total of 3.139 million tourists arriving by both land and air. This remarkable year set a substantial benchmark for the nation’s tourism endeavors.

Despite the encouraging growth in 2023, the total number of visitors falls short of the record set in 2019. During the first five months of 2023, approximately 1,477,237 visitors arrived by land and air, representing an increase of approximately 16.3% compared to the current figures.

The tourism industry remains a formidable engine driving the Costa Rican economy, generating 158,810 direct jobs during the first quarter of 2023. This upward trajectory is expected to continue as more and more tourists embark on their journeys to this enchanting country.

A particularly promising aspect of the 2023 tourism data is the substantial growth in visitors from North America. Over the first five months of 2023, Costa Rica welcomed 850,530 visitors from North America, signifying a notable 4.85% increase compared to the 811,317 North American visitors during the same period in 2019.

Likewise, the European sector has also demonstrated a positive trend in 2023, with 242,425 visitors arriving from Europe during the initial five months of the year, marking an impressive 5.56% rise compared to the 229,748 European visitors in 2019.

The 2023 tourism data indicates a robust recovery and growth in the industry, showcasing a promising momentum despite the lingering effects of the pandemic. While the current visitor numbers may not match the exceptional records set in 2019, the continuous growth in North American and European sectors presents a bright outlook for the country’s tourism prospects. As Costa Rica continues to adapt and allure visitors with its natural wonders and diverse offerings, the tourism sector is poised for further development in the ensuing months and years.

Growing Demand for Passports and Emigration Trends:

In a related context, the United States has experienced a remarkable surge in passport applications. The State Department issued a record 22 million passports in 2022, a number projected to be surpassed in 2023. Weekly applications are currently reaching half a million, indicating a substantial 30 to 40% increase compared to the previous year. This surge is attributed to the easing of pandemic-related travel restrictions and the growing number of Americans planning international travel.

Similarly, recent data from Statistics Canada reveals a notable increase in the number of Canadians leaving the country permanently, particularly in the fourth quarter of 2021. The Q4 emigration volumes in 2022 were the highest since the 1970s, highlighting a significant trend. While Canada’s population continues to grow due to high immigration rates, the rising outflow of residents poses challenges. Many individuals are considering their options, with factors like expensive housing and limited economic opportunities driving them to explore alternative destinations for real estate investment, such as Costa Rica. The allure of Costa Rica’s warmer climate and potentially more favorable economic conditions make it an appealing prospect for those seeking new horizons.

Construction Permits in Costa Ballena

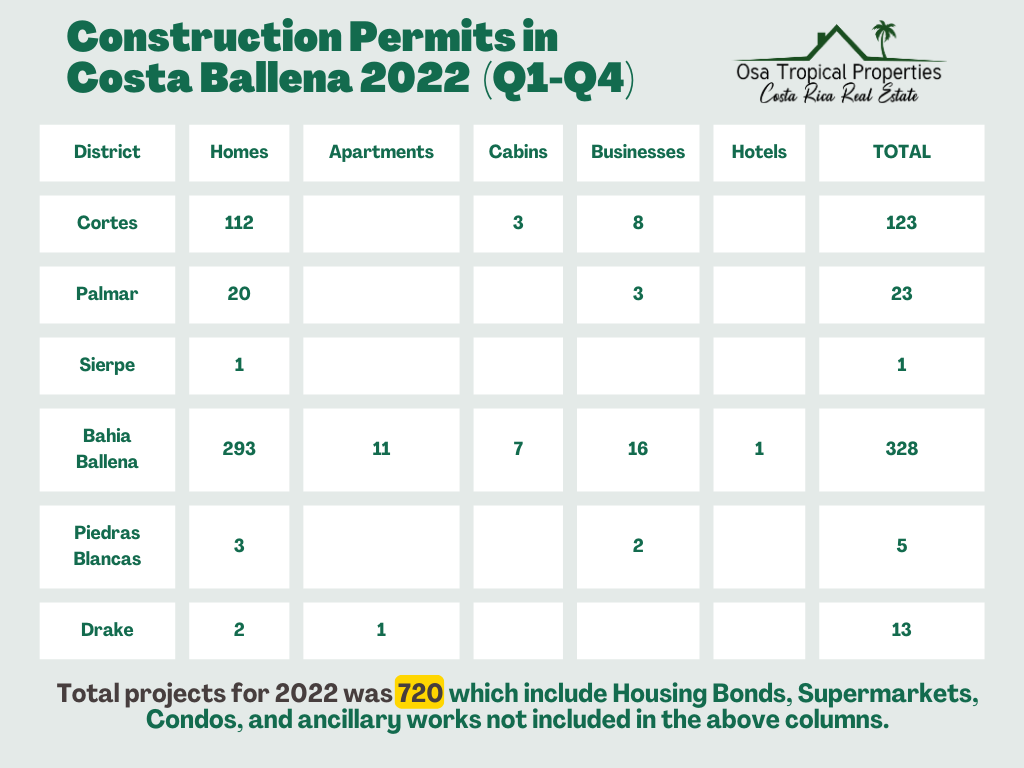

In the year 2022, a total of 720 projects were approved in the canton (province), distributed among its different districts. The district of Cortes includes Ojochal, whereas the district of Bahia Ballena includes the towns of Uvita and Dominical and their surrounding areas. The table displays the distribution of these projects by type in 2022:

Construction Project Types By District in 2022:

The table shows that the districts of Bahia Ballena, Cortes, and Palmar are the areas where the most construction permits are processed, especially for residential and commercial projects.

As of the date of this report in 2023, a total of 329 projects have been counted throughout the canton. The table below provides a detailed breakdown of the projects by typologies in each district:

Construction Project Types By District in 2023 (January – June):

Similar to the previous year, in 2023, the districts of Bahia Ballena, Cortes, and Palmar lead in terms of approved construction permits, mainly for residential projects. It is projected that the number of approved projects for this year will exceed the previous year’s count.

Investment Opportunities

The Costa Ballena real estate market offers diverse investment opportunities, including residential properties, commercial properties, industrial properties, and vacation rental properties. Residential properties are particularly popular due to the region’s natural beauty, tourist appeal, and attractiveness to foreign buyers. They can be rented out for short or long-term stays, providing a steady income stream.

Prospective buyers of Costa Ballena real estate predominantly want to see modern, ocean view homes with some land and privacy under $1 million. This is the sweet spot in the market that is very challenging to supply. New properties entering the market in this bracket sell quickly and it seems that the supply cannot keep up with the demand. These buyers do not tend to settle on older homes, but rather will look for land on which they can build the modern home of their dreams. Building is not typically their first choice, therefore opportunities are available for developers aiming at supplying this sweet spot in the market.

Future Outlook

The Costa Ballena real estate market is poised to maintain its upward trajectory in the coming years, fortified by a multitude of compelling factors. The region’s extraordinary natural beauty, combined with its allure to retirees and digital nomads, alongside its status as a sought-after tourist destination, will undoubtedly continue to drive robust demand for properties in Costa Ballena.

However, prospective investors must exercise prudence and remain mindful of associated risks. The limited supply of properties, coupled with strong demand and a rising cost of living in Costa Rica, may impact the market’s overall stability. Thus, cautious consideration of these variables is highly recommended before embarking on real estate investment ventures in Costa Ballena. While the market’s outlook is promising, investors should be cognizant of its cyclical nature, characterized by periods of growth and occasional declines.

Conclusion

The Costa Ballena real estate market stands as an enticing and spirited landscape, characterized by high demand and limited supply. The region’s sublime natural beauty, strategic proximity to major airports, and escalating appeal to foreign investors form the bedrock of the market’s allure. Foreign investors, in particular, are drawn to Costa Ballena’s alluring attributes, including its low cost of living and a stable investment environment, bolstered by a government that upholds property rights.

Within the market’s diverse landscape, investment opportunities abound, encompassing residential, commercial, industrial, and vacation rental properties. Nevertheless, buyers must remain mindful of the limited supply of modern ocean view homes and the competitive seller’s market while contemplating purchasing decisions.

The future outlook for the Costa Ballena real estate market remains bright, propelled by factors like its burgeoning reputation as a premier tourist destination, the expansion of the tourism industry, and the surging demand for sustainable and eco-friendly properties.

Prospective investors are urged to embark on thorough research and seek counsel from seasoned real estate agents before engaging in the Costa Ballena market. While the region offers substantial potential for lucrative ventures, a comprehensive understanding and effective management of associated risks are pivotal to achieving success in the realm of Costa Rican real estate.

The information provided in this Real Estate Market Report is for general informational purposes only and should not be considered as investment advice. Readers are encouraged to independently verify the data and seek advice from qualified experts before making any real estate decisions.